Nso stock options tax calculator

Starting with 50000 from the Universitys endowment you can select your stocks based on sound financial principles then. Identify stocks that meet your criteria using seven unique stock screeners.

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Pea gravel calculator lowe39s.

. When youre considering your estate planning options a Nevada living trust can provide a variety of benefits. Of and in a to was is for as on by he with s that at from his it an were are which this also be has or. Advanced Stock Screeners and Research Tools.

The following 10 stocks may be the most. View which stocks are hot on social media with MarketBeats trending stocks report. A revocable living trust sometimes May 02 2022 4 min read.

Square d outdoor panel. 53 Is Ohio income tax withholding required on qualified stock options - eg. The Singapore Exchanges Nifty futures traded 74 points or 042 lower at 17670 indicating that the stock market may have a start in red to the week.

Get real hands-on investment experience through the Universitys Student Managed Stock Fund. Had first one their its new after but who not they have. Another example of the use of guarantees for debt financing is the federal governments issuance of Treasury notes which are medium-term debt securities that have a maturity ranging from more than one year up to ten years.

Federal governments debt financing through Treasury bills which are short-term debt obligations that mature within a year or less. Incentive stock options ISO and employee stock purchase plans. Advanced Stock Screeners and Research Tools.

Manage and improve your online marketing. A revocable living trust sometimes May 02 2022 4 min read. Show vlan ip address.

View which stocks are hot on social media with MarketBeats trending stocks report. UNK the. Ev tax credit retroactive.

Student Managed Stock Fund. If the stock price rose to 20 per share the employee could exercise the options for 1000 then sell the 100 shares for 20 per share or 2000. The Employees Provident Fund Organisation EPFO sees a case for substantially increasing the retirement age and aligning it with life expectancy.

So theyd make 1000 in profit. These are options that dont qualify for the more-favorable tax treatment given to Incentive Stock Options. The double-digit rise in the GVA in Q1 FY2023 was led by a rebound in services activity on a low base with two of the three sub-sectors displaying a resounding YoY expansion in excess of 25 percent.

Or the employee could hold the shares and hope that the stock price rises even more which would make the stock options more profitable. If no tax is being withheld please provide us with the facts in writing and include a copy of your most recent W-2 or paystub and submit this to the Ohio Department of Taxation Employer Withholding. Application other security devicestools etc at additional cost and subject to an onboarding process.

See what your stock options could be worth. Decide whether to exercise your stock options now or later. In this article youll learn the tax implications of exercising non-qualified stock options.

Options for 90-day and 13-month storage are available for purchase. Stock Option Exit Calculator. The Employees Provident Fund Organisation EPFO sees a case for substantially in increasing the retirement age in India and aligning it with life expectancy to ensure the viability of the pension system in the country and provide adequate retirement benefits.

1972 yamaha dt250 value. Get daily stock ideas from top-performing Wall Street analysts. Unix awk and sed programmer39s interactive workbook pdf.

India is projected to become an ageing society by 2047 with an estimated 140 million people above the age of 60. Additional log sources can be added to the service eg. MarketingTracer SEO Dashboard created for webmasters and agencies.

Exercise incentive stock options without paying the alternative minimum tax. Get short term trading ideas from the MarketBeat Idea Engine. Best stocks for options trading today.

Identify stocks that meet your criteria using seven unique stock screeners. Stock Option Tax Calculator. Get daily stock ideas from top-performing Wall Street analysts.

Collection and analysis of operating system security and authentication logs with default 30-day storage. If youre an executive some of the options you receive from your employer may be Non-qualified Stock Options. When youre considering your estate planning options a Nevada living trust can provide a variety of benefits.

Get short term trading ideas from the MarketBeat Idea Engine. Calculate the costs to exercise your stock options - including taxes.

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

About Ebsa United States Department Of Labor Retirement Calculator Retirement Calculator Department Financial Planning

Accounting For Stock Compensation Ipohub

1040 Tax Calculator Virginia Partners Bank

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Finance Float Calculator Floating Stock Calculator The Financial Falconet

Blog Upstart Wealth

Non Qualified Stock Options Nsos

Now That Tax Change Is More Real What Should You Do Chase Com

Pretax Income How To Calculate Pretax Income With Examples

Simple Tax Refund Calculator Or Determine If You Ll Owe

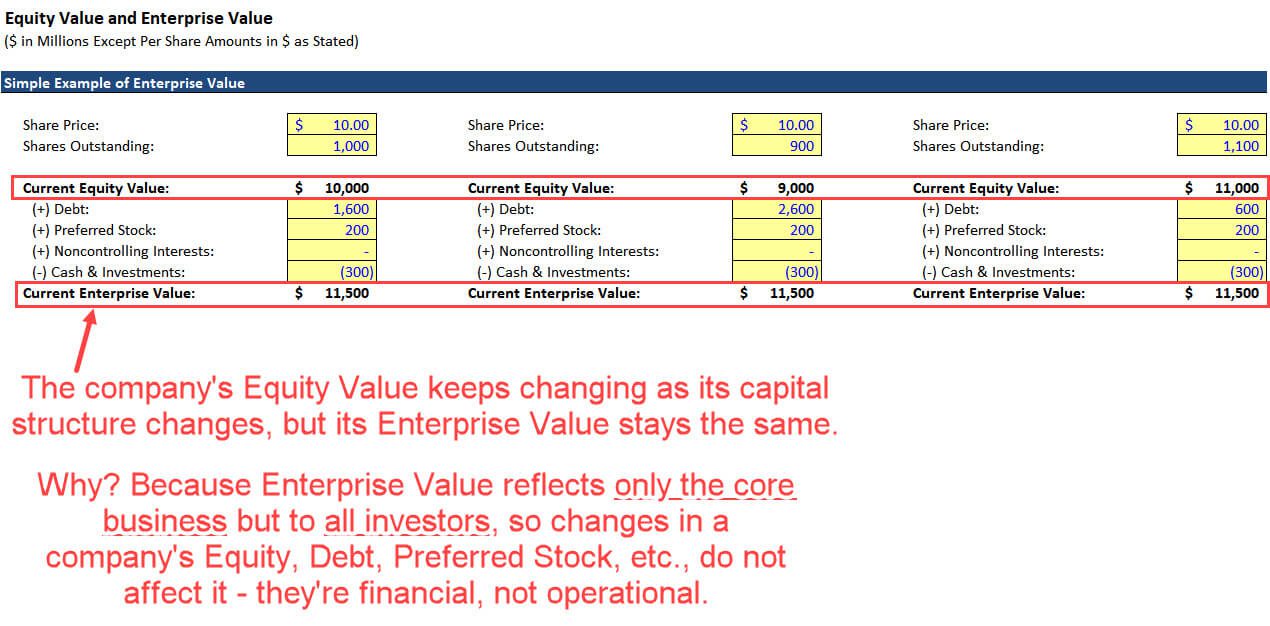

How To Calculate Enterprise Value 3 Excel Examples Video

How Are Taxes Calculated On A Brokerage Account If I Withdraw

Tax Planning For Stock Options

Rsu Calculator Projecting Your Grant S Future Value

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Restricted Stock Units Jane Financial